ProLogis Closes Tender Offer for Any and All of Its 5.25 Percent Notes Due November 15, 2010

December 18 2008 - 9:00AM

PR Newswire (US)

DENVER, Dec. 18 /PRNewswire-FirstCall/ -- ProLogis (NYSE:PLD), a

leading global provider of distribution facilities, today announced

that it has accepted for purchase approximately $310 million

principal amount of its 5.25 percent Notes due November 15, 2010

(the "Notes") validly tendered pursuant to its previously announced

cash tender offer for the Notes (the "Tender Offer"). The Notes

accepted for purchase represent approximately 62 percent of the

principal amount of Notes outstanding prior to the Tender Offer.

The Tender Offer expired at 11:59 p.m., New York City time, on

Wednesday, December 17, 2008 (the "Expiration Time"). Payment for

Notes purchased pursuant to the Tender Offer is expected to be made

on Thursday, December 18, 2008 (the "Payment Date"). The

consideration to be paid for each $1,000 principal amount of Notes

accepted for payment will be $700 for Notes validly tendered and

not withdrawn at or prior to the Expiration Time. In addition, each

tendering holder of Notes accepted for payment will be paid accrued

and unpaid interest on such Notes from the last interest payment

date up to, but not including, the Payment Date. The aggregate

consideration for Notes accepted for payment is expected to be

approximately $217 million, plus accrued and unpaid interest. The

Tender Offer was made pursuant to the Offer to Purchase dated

December 11, 2008 and the related Letter of Transmittal. J.P.

Morgan Securities Inc. acted as Dealer Manager for the Tender

Offer. This press release is neither an offer to purchase nor a

solicitation to buy any of these Notes. About ProLogis ProLogis is

the world's largest owner, manager and developer of distribution

facilities, with operations in 136 markets across North America,

Europe and Asia. The company has $40.8 billion of assets owned,

managed and under development, comprising 548 million square feet

(51 million square meters) in 2,898 properties as of September 30,

2008. ProLogis' customers include manufacturers, retailers,

transportation companies, third-party logistics providers and other

enterprises with large-scale distribution needs. The statements

above that are not historical facts are forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These forward-looking statements are based on current

expectations, estimates and projections about the industry and

markets in which ProLogis operates, management's beliefs and

assumptions made by management, they involve uncertainties that

could significantly impact ProLogis' financial results. Words such

as "expects," "anticipates," "intends," "plans," "believes,"

"seeks," "estimates," variations of such words and similar

expressions are intended to identify such forward-looking

statements, which generally are not historical in nature. All

statements that address operating performance, events or

developments that we expect or anticipate will occur in the future

- including statements relating to rent and occupancy growth,

development activity and changes in sales or contribution volume of

developed properties, general conditions in the geographic areas

where we operate and the availability of capital in existing or new

property funds - are forward-looking statements. These statements

are not guarantees of future performance and involve certain risks,

uncertainties and assumptions that are difficult to predict.

Although we believe the expectations reflected in any

forward-looking statements are based on reasonable assumptions, we

can give no assurance that our expectations will be attained and

therefore, actual outcomes and results may differ materially from

what is expressed or forecasted in such forward-looking statements.

Some of the factors that may affect outcomes and results include,

but are not limited to: (i) national, international, regional and

local economic climates, (ii) changes in financial markets,

interest rates and foreign currency exchange rates, (iii) increased

or unanticipated competition for our properties, (iv) risks

associated with acquisitions, (v) maintenance of real estate

investment trust ("REIT") status, (vi) availability of financing

and capital, (vii) changes in demand for developed properties, and

(viii) those additional factors discussed in "Item 1A. Risk

Factors" of ProLogis' Quarterly Report on Form 10-Q for the quarter

ended September 30, 2008 and in "Item 1A --Risk Factors" in

ProLogis' Annual Report on Form 10-K for the year ended December

31, 2007. ProLogis undertakes no duty to update any forward-looking

statements appearing in this press release. DATASOURCE: ProLogis

CONTACT: Melissa Marsden of ProLogis, +1-303-567-5622, Web Site:

http://www.prologis.com/

Copyright

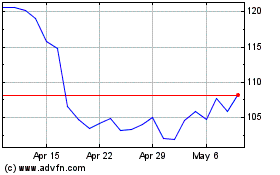

Prologis (NYSE:PLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

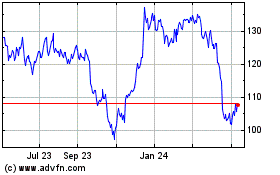

Prologis (NYSE:PLD)

Historical Stock Chart

From Apr 2023 to Apr 2024